You can put more into your APS 401(k) than you probably think—$70,000+ in 2025.

Most People think the limit is $23,500 if you’re under 50 or $31,000 if you’re over 50, and that’s true for the Pre-Tax and Roth parts of the APS 401(k) Plan.

But there’s another way to get more money in:

After-Tax 401(k) Contributions

Think of these as a blend of Pre-Tax and Roth:

- You pay taxes on the money you put in now (like Roth)

- The earnings grow tax-deferred and are taxed when you pull them out (like Pre-Tax)

Why it Matters:

After-Tax contributions are what allow you to contribute above the standard limits. You can also rollover/convert your After-Tax contributions into Roth. When you do that, growth from then on allows retirement distributions to be tax-free.

Example:

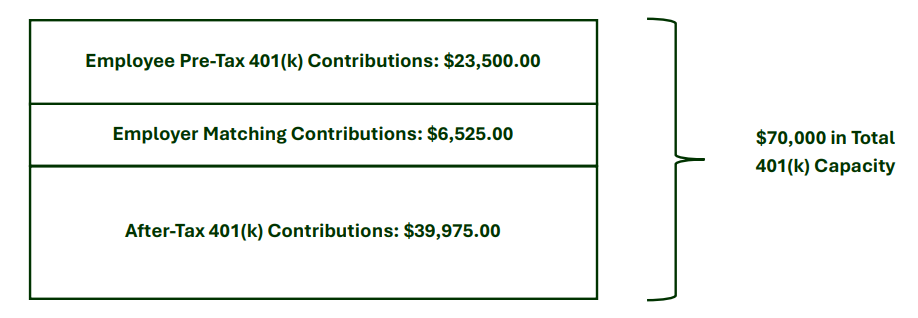

A 45-year-old lineman’s base compensation is $145,000 in 2025. This is what fully maximizing his 401(k) plan could look like:

Allow us to identify if After-Tax 401(k) contributions make sense for you.

Chandler Cole, CFP©

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

LPL Financial, Knapp Capital Management, and Arizona Public Service (APS) are separate entities.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.